Gas Turbines Market Size, Share, Growth Report 2030

Gas Turbines Industry Prospective:

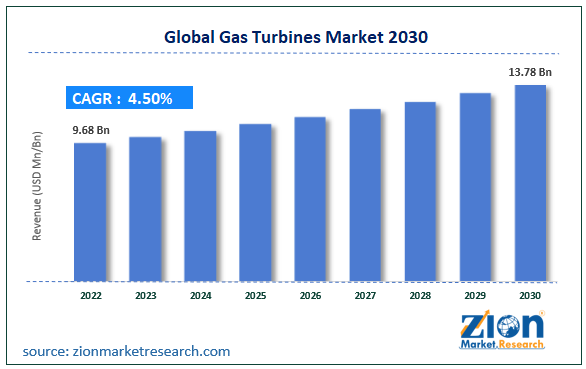

The global gas turbines market size was worth around USD 9.68 billion in 2022 and is predicted to grow to around USD 13.78 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.50% between 2023 and 2030.

Gas Turbines Market: Overview

A gas turbine is a combustion engine and forms the heart of a power plant. It is used for converting natural gas or other fuels in liquid form to mechanical energy that is further used to generate electrical energy by powering the generator. The energy thus obtained is used in several residential, commercial, and industrial settings. The function of a gas turbine depends on the supply of pressurized gas for the tool to spin and generate electricity. Gas turbines are also used to power a jet or an aircraft through a process called the Brayton cycle. The pressurized gas is generated by burning fuel such as kerosene, natural gas, jet fuel, or propane. At the end of the process, the heat generated helps to expand the air flowing through the turbine to supply the necessary amount of energy.

In theory, gas turbines are made of three essential parts including combustor, compressor, and turbine. The compressor performs the role of taking in air from the outside surrounding of the turbine and amplifying its pressure. The combustor burns the added fuel and produces high-velocity and high-pressure gas. The turbine, in the end, extracts energy from the gas released by the combustor. The industry for gas turbines is growing as per expectations but during the forecast period, multiple challenges can lead to growth resistance.

Key Insights:

- As per the analysis shared by our research analyst, the global gas turbines market is estimated to grow annually at a CAGR of around 4.50% over the forecast period (2023–2030)

- In terms of revenue, the global gas turbines market size was valued at around USD 9.68 billion in 2022 and is projected to reach USD 13.78 billion, by 2030.

- The gas turbines market is projected to grow at a significant rate due to the growing energy requirements across commercial settings

- Based on technology segmentation, the open cycle was predicted to show maximum market share in the year 2022

- Based on capacity segmentation, >70 to 200 MW was the leading segment in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Gas Turbines Market: Growth Drivers

Growing energy requirements across commercial settings to drive market growth

The global gas turbines market is expected to grow due to the increasing demand for constant supply of power and energy in the rapidly growing commercial sector. It includes providing energy to facilities such as business offices, entertainment centers, recreational units, parking lots, restaurants, cafes, hotels, and other units capable of accommodating large groups of people frequently. The increasing investments in infrastructure development projects including skyscrapers and other facilities meant to help the economy grow are projected to act as a leading growth factor. These facilities have a high demand for energy required to power air-conditioning or heating systems, lighting fixtures, automatic doors, and other units.

For instance, in 2019, the construction of the Al Maryah Central mall in Abu Dhabi built on a total investment of USD 1 billion spans across 2.8 million square feet, and is home to over 400 retail stores. Research suggests that the annual energy consumption of an average open office, private office, or coworking office is 76 kWh/m 2, 60 kWh/m 2, and 170 kWh/m 2 respectively. The rising number of coworking spaces demands more energy. Governments are working toward deploying large-scale power-generating plants to ensure that the energy needs of globalizing and modernizing economies are met.

Gas Turbines Market: Restraints

Technical constraints related to gas turbine functions may restrict market growth

Gas turbines, although theoretically simple, are complex equipment mainly because of their functional attributes. The use of these machines entails working with hazard-prone fuel at high temperatures and any negligence at any point of gas turbine application could result in catastrophic events. Several technical constraints associated with gas turbines are expected to restrict the global gas turbine market growth. For instance, the most common issue faced with gas turbine engines is blade damage caused by corrosion, fatigue, erosion, thermal stress, and foreign object damage. It can result in reduced engine durability, performance, and efficiency. In addition to this, seal leakage caused by falling off of seals preventing escape of high-pressure gasses causing increased fuel consumption, is another crucial often observed technical limitation with gas turbines. Other issues such as malfunction of turbine cooling systems, bearing failure, performance deterioration, and negligence in observing safety precautions are likely to inhibit market growth.

Gas Turbines Market: Opportunities

Growing strategic partnerships and innovation have tremendous growth potential

The gas turbines industry has several growth opportunities in the future especially due to growing strategic partnerships to improve the overall landscape of business transactions related to gas turbines. Constant innovation and development are projected to further strengthen the objective of the partnering firms. For instance, in February 2023, GE India Industrial Pvt Ltd (GEIIPL), a part of the global giant GE announced that it had received a contract to supply marine gas turbine solutions for the Indian Navy, especially for Indian Navy Ship (INE) Vikrant. It is the country’s indigenous aircraft. In January 2018, GE Power was awarded a contract from Jiangsu Etern Company Ltd powering GE to supply the company’s latest gas turbine for Jiangsu’s upcoming 100-MW plant in Bangladesh.

Increasing application in the aerospace industry holds high expansion possibilities

Gas turbines are an essential part of modern military and commercial aircraft. They are used for aircraft propulsion and have become an integral part of the global aircraft industry. The rising efforts toward strengthening regional defense bases in the backdrop of the changing world order are expected to create new expansion possibilities for gas turbine manufacturers and suppliers. In July 2023, GE Marine announced the signing of an agreement with Turkey’s TAIS OG-STM Is Ortakligi. As per agreement conditions GE will supply LM2500 marine gas turbine engine for the Istif-Class frigates, numbers 6, 7, and 8 that are a part of the Turkish MILGEM Project.

Gas Turbines Market: Challenges

Stringent government regulations regarding environmental impact to challenge market growth

The global gas turbine market growth trend is expected to be challenged by the stringent environmental regulations that surround the supply and use of gas turbines since they run on non-renewable energy sources such as kerosene. The burning of liquid fuel damages the ecosystem by releasing greenhouse gasses and depleting resources. Furthermore, the changing landscape of fuel availability and prices may impact market expansion plans along with the growing threat of replacement by sustainable solutions such as electric power plants and hybrid electricity generating systems. Other aspects such as managing noise pollution and managing fuel efficiency over a period add to existing problems.

Gas Turbines Market: Segmentation

The global gas turbines market is segmented based on technology, product, capacity, and region.

Based on technology, the global market is segmented into combined cycle and open cycle. In 2022, the highest growth was observed in the open cycle segment. It is expected to cross over USD 6 billion in revenue by 2030. These turbines have high applications in the power generation segment including mechanical drive and direct uses. Open cycle gas turbines start quickly and do not require large quantities of cooling water making them suitable for a large range of applications. The growing expansion of the power generation sector as the demand from end consumers is growing rapidly could help in future segmental growth. The rising urbanization rate along with rampant industrialization and commercialization are projected to act as crucial drivers.

Based on product, the gas turbine industry is divided into heavy-duty and aero-derivative.

Based on capacity, the gas turbine industry divisions are >200 MW, >70 to 200 MW, >30 to 70 MW, >1 to 30 MW, >500 kW to 1 MW, >50 kW to 500 kW, < 50 kW. In 2022, >70 to 200 MW controlled more than 15.5% of the total revenue due to higher applications in several medium and small-sized power-generating plants. The rising trend of energy unit co-generation to meet the growing demands for heat and energy requirements will act as a segmental propeller during the forecast period. The 1 to 30 MW is also projected to grow at a significant rate.

Gas Turbines Market: Report Scope

Report AttributesReport DetailsReport NameGas Turbines MarketMarket Size in 2022USD 9.68 billionMarket Forecast in 2030USD 13.78 billionGrowth RateCAGR of 4.50%Number of Pages226Key Companies CoveredMitsubishi Power, General Electric (GE), Bharat Heavy Electricals Limited (BHEL), Siemens Energy, PW Power Systems, Siemens Gamesa Renewable Energy, MTU Aero Engines, Opra Turbines, Ansaldo Energia, Vericor Power Systems, Kawasaki Heavy Industries, and others.Segments CoveredBy Technology, By Product, By Capacity, and By RegionRegions CoveredNorth America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA)Base Year2022Historical Year2017 to 2021Forecast Year2023–2030Customization ScopeAvail customized purchase options to meet your exact research needs. Request For Customization

Gas Turbines Market: Regional Analysis

North America to register the highest growth rate in the near future

The global gas turbines market is expected to witness the highest growth in North America with the US holding the largest regional market share. The presence of key gas turbine producers and suppliers for all major industrial and military applications to clients across the globe is the most crucial growth propeller. These companies are innovation-driven and are focusing on visionary developers. In 2019, GE launched the next generation of hydrogen-assist (HA) gas turbine the 7HA.03 in association with MYTILINEOS S.A., a Greek-based company. In June 2023, GE Aerospace and Hindustan Aeronautics Limited (HAL), India signed a pact to produce jet engines in India.

Europe is expected to continue growing at a fast pace owing to the growing increased investments in gas turbine innovation and strategic collaborations. In May 2020, Siemens, a German company, launched the world’s most powerful and highly efficient heavy-duty gas turbine called the SGT5–9000 HL turbine. The company has already managed to sell 7 HL-Class engines as per official records.

Gas Turbines Market: Competitive Analysis

The global gas turbines market is led by players like:

- Mitsubishi Power

- General Electric (GE)

- Bharat Heavy Electricals Limited (BHEL)

- Siemens Energy

- PW Power Systems

- Siemens Gamesa Renewable Energy

- MTU Aero Engines

- Opra Turbines

- Ansaldo Energia

- Vericor Power Systems

- Kawasaki Heavy Industries

The global gas turbines market is segmented as follows:

By Technology

- Combined Cycle

- Open Cycle

By Product

- Heavy Duty

- Aero-Derivative

By Capacity

- >200 MW

- >70 to 200 MW

- >30 to 70 MW

- >1 to 30 MW

- >500 kW to 1 MW

- >50 kW to 500 kW

- < 50 kW

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa